What if I receive a Vape PACT Act Cease and Desist Letter?

In recent times, the vape industry has seen a surge in cease and desist letters, particularly concerning the sale of flavored electronic nicotine delivery system (ENDS) products. Notably, R.J. Reynolds Vapor Company ([TCVD]) and its legal representatives have been active during 2023 and 2024 in this realm. These letters underscore the significance of compliance with federal laws like the Prevent All Cigarette Trafficking Act (PACT Act) for vape businesses.

The Focus on PACT Act Compliance

Central to these letters is the enforcement of the PACT Act, which lays down various regulations for businesses dealing with vape products. These regulations encompass shipping methods, package labeling, age verification, and taxation. Non-compliance with the PACT Act can result in severe penalties, including fines and legal actions against vape companies.

Identifying Compliance Concerns

Cease and desist letters often highlight specific areas where businesses may be falling short in PACT Act compliance. These areas include inadequate age verification measures, improper labeling, or failure to adhere to taxation requirements. By pinpointing these issues, the letters aim to prompt corrective action and ensure adherence to federal regulations.

What to do if you receive a PACT Act Cease and Desist Letter?

- Review the cease and desist letter carefully to understand the allegations against your business.

- Assess your current compliance practices to identify potential areas of concern.

- Seek legal counsel experienced in navigating the complexities of the PACT Act.

- Work with your legal representative to evaluate the validity of the claims in the letter and devise an appropriate response strategy, including addressing any compliance deficiencies highlighted.

- Understand the specific claims against your business regarding PACT Act compliance, whether related to age verification, packaging labeling, taxation, or monthly reports.

- Take proactive steps to address these compliance issues, including selecting reputable age verification providers, implementing necessary changes in labeling and reporting practices, and utilizing software solutions like Token of Trust for automated reporting and tax compliance.

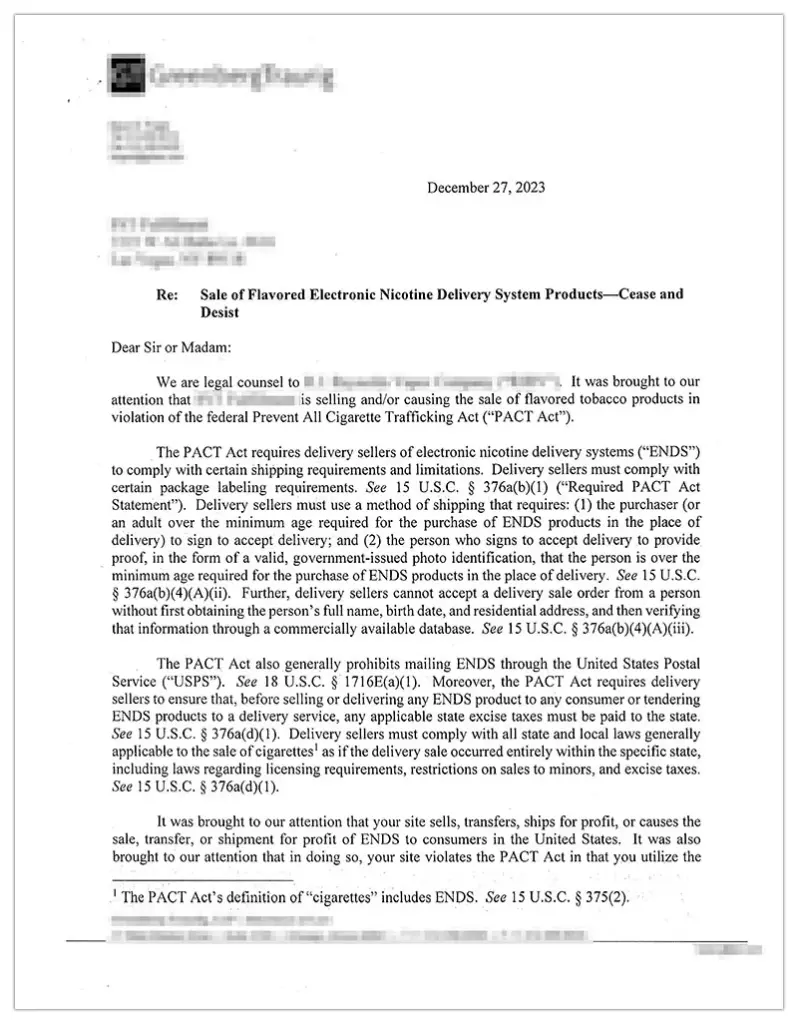

Examining a Specific Example

Consider the anonymized letter below, which exemplifies the issues addressed in these notices:

[Anonymized Letter]

[Omitted Law Firm Name and Address]

December 27, 2023

[Recipient’s Name and Address Omitted]

Re: Sale of Flavored Electronic Nicotine Delivery System Products—Cease and Desist

Dear Sir or Madam:

We are legal counsel to [Tobacco Company’s Vape Division AKA ‘TCVD]. It was brought to our attention that [Recipient’s Name] is selling and/or causing the sale of flavored tobacco products in violation of the federal Prevent All Cigarette Trafficking Act (“PACT Act”).

The PACT Act requires delivery sellers of electronic nicotine delivery systems (“ENDS”) to comply with certain shipping requirements and limitations. Delivery sellers must comply with certain package labeling requirements. See 15 U.S.C. § 376a(b)(1) (“Required PACT Act Statement”). Delivery sellers must use a method of shipping that requires: (1) the purchaser (or an adult over the minimum age required for the purchase of ENDS products in the place of delivery) to sign to accept delivery; and (2) the person who signs to accept delivery to provide proof, in the form of a valid, government-issued photo identification, that the person is over the minimum age required for the purchase of ENDS products in the place of delivery. See 15 U.S.C. § 376a(b)(4)(A)(ii). Further, delivery sellers cannot accept a delivery sale order from a person without first obtaining the person’s full name, birth date, and residential address, and then verifying that information through a commercially available database. See 15 U.S.C. § 376a(b)(4)(A)(iii).

The PACT Act also generally prohibits mailing ENDS through the United States Postal Service (“USPS”). See 18 U.S.C. § 1716E(a)(1). Moreover, the PACT Act requires delivery sellers to ensure that, before selling or delivering any ENDS product to any consumer or tendering ENDS products to a delivery service, any applicable state excise taxes must be paid to the state. See 15 U.S.C. § 376a(d)(1). Delivery sellers must comply with all state and local laws generally applicable to the sale of cigarettes as if the delivery sale occurred entirely within the specific state, including laws regarding licensing requirements, restrictions on sales to minors, and excise taxes. See 15 U.S.C. § 376a(d)(1).

It was brought to our attention that your site sells, transfers, ships for profit, or causes the sale, transfer, or shipment for profit of ENDS to consumers in the United States. It was also brought to our attention that in doing so, your site violates the PACT. Act in that you utilize the USPS to ship ENDS products without meeting any of the narrow exceptions that would permit such a shipment; fail to label packages for shipment consistent with that federal law; and fail to use a method of shipping that verifies, through government-issued identification, that the purchaser is of age for such products.

[TCVD] therefore demands that you immediately cease and desist from selling and/or causing the sale of ENDS products in violation of the PACT Act. If you continue the conduct described above, [TCVD] reserves the rights to pursue all available legal remedies, including but not limited to filing a lawsuit in federal court against you for violating the PACT Act.

To avoid the potential of a lawsuit in federal court, please provide your written assurance by 5:00 p.m., January 5, 2024, that you have complied with the demands set forth in this letter and ceased all sales of ENDS in violation of the PACT Act. In the absence of a timely response, we have been authorized to take all steps necessary to preserve and protect the rights of [TCVD] without further notice to you.

This letter is not a complete statement of [TCVD]’ s rights in connection with this matter, and nothing contained herein constitutes an express or implied waiver of any rights, remedies, or defenses of [TCVD] in connection with this matter, all of which are expressly reserved.

Very truly yours,

[End of Anonymized Letter]

Token of Trust: Your Compliance Partner

Token of Trust’s suite of compliance solutions is tailored to support vape manufacturers, distributors, and retailers in meeting PACT Act requirements.

Streamlined PACT Act Reporting

Our user-friendly software simplifies the preparation and filing of monthly PACT Act Reports, ensuring timely and accurate compliance submissions.

Efficient Tax Calculation and Collection

Token of Trust streamlines the calculation and collection of excise taxes on vape products, ensuring compliance with state and local tax regulations.

Seamless Age Verification

Integrate our age verification products seamlessly into your website’s checkout process to verify customer ages and comply with vape product purchase restrictions.

Stay Ahead with Token of Trust

By partnering with Token of Trust, vape businesses can navigate regulatory complexities with confidence and demonstrate a commitment to responsible practices. Additionally, VapeTaxes.com offers an innovative solution that complements these efforts by providing detailed state-specific reports, handling excise taxes during online purchases, and ensuring identity and age verification. Contact us today to learn more about how we can support your compliance efforts in the evolving vape industry landscape.