Fraud Prevention Tips For E-Commerce For The Holiday Season

As the holiday season approaches, e-commerce fraud risks rise alongside increased online shopping activity. Viewing fraud as an unavoidable cost isn’t just inadequate — it’s risky. Inaction can result in significant financial losses and erode customer trust.

Proactive fraud prevention not only safeguards your revenue but also enhances customer success and builds lasting trust. For merchants, preparing for the holiday rush is about more than boosting sales; it’s about ensuring a secure and seamless shopping experience.

How prepared is your business to tackle the challenges of the upcoming holiday season?

How Fraud Prevention Protects Revenue, Build Customer Trust, & Accelerates Growth

Looking at fraud prevention not just as a way to protect your business, but also as a tool for growth, can help you see it as an important investment in your success. By creating a safe environment, fraud prevention is key to boosting business growth, building trust, improving efficiency, and ensuring long-term success.

Protects Revenue Streams

Fraud prevention protects a company’s revenue by reducing losses from fraudulent transactions. In sectors like banking, e-commerce, and insurance, where fraud can drain resources, it helps businesses retain earnings and maintain healthy profit margins. This, in turn, supports reinvestment in growth initiatives like product development, marketing, and expansion.

Builds Customer Trust

Fraud prevention strengthens customer trust by safeguarding personal data and transactions, enhancing a business’s reputation for security. This commitment to protection fosters loyalty and improves retention, as customers gravitate toward companies that prioritize their safety.

Account Takeover (ATO) attacks, for instance, can severely damage customer trust, leading to dissatisfaction and eventual churn. Token of Trust’s services help prevent these issues, securing personal information and maintaining customer loyalty.

Similarly, proactive measures against phishing and social engineering attacks protect brand reputation and reinforce customers’ confidence in the platform. Leveraging modern fraud detection tools, including AI and machine learning, businesses can swiftly identify and counter emerging threats, minimizing potential damage and solidifying trust.

Supports Compliance

Compliance with regulations is crucial, especially for businesses handling sensitive data. Failure to meet legal requirements can result in fines, penalties, or loss of licenses. A strong fraud prevention strategy ensures compliance, avoids legal issues, and maintains a transparent reputation, attracting investors, customers, and partners. Reliable technology that ensures compliance with regulations like GDPR and CCPA also helps retain customers and avoid penalties.

Enables Scalable Growth

As businesses expand, especially internationally, fraud risks grow more complex. A strong fraud prevention system enables safe entry into new markets by adapting to local risks and regulations. This allows businesses to scale confidently and innovate, launching new technologies like digital wallets or e-commerce platforms without significant risk.

Facilitates Stronger Partnerships

Businesses that prioritize fraud prevention are more attractive to investors, partners, and suppliers seeking to reduce risk. Companies committed to security, like Token of Trust, can build trusted, long-term relationships with others offering innovative fraud prevention solutions. This leads to stronger partnerships and growth opportunities, while secure systems enhance their competitive position in the market.

Common E-Commerce Fraud Risks During Holidays

During the holiday season, e-commerce businesses face a rise in fraud due to increased transaction volumes. Common types of fraud include:

1. Credit Card Fraud

Credit card fraud happens when criminals steal card information to make unauthorized purchases, resulting in financial losses for both the cardholder and the merchant. Merchants may face chargebacks, where transactions are reversed by the card issuer, along with chargeback fees, higher transaction costs, and potential penalties if fraud levels are high.

2. Account Takeover (ATO)

Fraudsters gain access to customer login details through phishing or data breaches, enabling unauthorized transactions that undermine trust and damage relationships. Account Takeover (ATO) can lead to financial losses, legal issues, and further harm to customer confidence, resulting in dissatisfaction and churn. Token of Trust’s services prevent these risks by securing personal information, helping to maintain customer loyalty.

3. Friendly Fraud (Chargeback Fraud)

Friendly fraud, or chargeback fraud, occurs when legitimate customers falsely claim a transaction was unauthorized or that they never received a product, leading to chargebacks. This results in financial loss for the business, as they lose both the product and the revenue, and increases administrative costs due to the time spent handling disputes.

4. Gift Card Fraud

Gift card fraud involves criminals using stolen credit card information to purchase gift cards, which are then either redeemed for goods or resold. Since gift cards are difficult to trace or recover, they provide an ideal way for fraudsters to convert stolen funds into a more usable form. Merchants may incur direct financial losses from these fraudulent transactions, and once the fraud is discovered, it can be hard to track down the criminals.

5. Return Fraud

It occurs when criminals purchase items with stolen or counterfeit payment methods and then return them for a refund, often with a receipt that’s either fake or altered. In some cases, fraudsters may return used or damaged items instead of the original product. This results in lost merchandise, refund costs, and administrative overhead for return processing.

6. Refund Fraud

Refund fraud happens when criminals purchase products with stolen credit card information and then request a refund, typically to a different bank account or credit card. This allows fraudsters to profit from both the stolen goods and the refunded amount, often leaving businesses with no way to recover the funds. Refund fraud is difficult to detect because the transactions appear legitimate at the point of sale.

7. Shipping Address Fraud

Shipping address fraud occurs when fraudsters use stolen credit card details to make a purchase and have the goods shipped to an address other than the cardholder’s. This allows the criminals to receive the goods without the original cardholder’s knowledge, often leading to financial losses for the business. Additionally, shipping to high-risk or unfamiliar addresses can lead to higher shipping costs and potential customer complaints.

8. Phishing and Social Engineering

Phishing and social engineering attacks involve fraudsters using misleading methods, such as fake emails, phone calls, or messages, to manipulate customers into revealing sensitive information like usernames, passwords, and credit card details. With this stolen data, fraudsters can steal money, commit identity theft, or hijack customer accounts. Preventing these attacks helps protect the brand’s reputation and boosts customer trust in the platform.

9. Synthetic Identity Fraud

This involves the creation of fake identities using a combination of real and fabricated information—such as a legitimate Social Security number paired with a fake name or date of birth. Because the information is a mix of real and false data, these synthetic identities are difficult for businesses to detect. Fraudsters use synthetic identities to open credit accounts or make fraudulent purchases, often without the identity ever being flagged.

10. Discount or Coupon Fraud

Discount or coupon fraud occurs when fraudsters exploit promotional codes, discounts, or fake accounts to gain unauthorized access to deals and reduce the price of goods or services. This can involve using expired or invalid promo codes, creating fake accounts to claim multiple offers, or utilizing bots to automatically apply discounts in bulk. Such activities erode profit margins and reduce the value of promotions for legitimate customers.

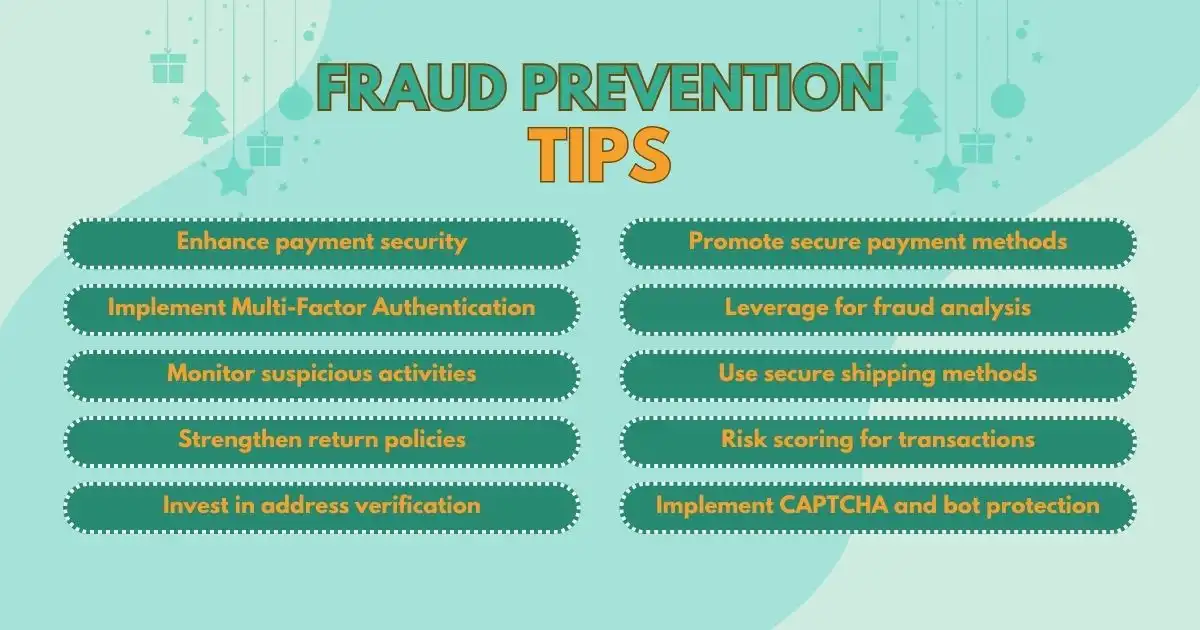

Essential Fraud Prevention Tips for the Holiday Season

To protect your e-commerce business from fraud during the busy holiday season, it’s important to adopt a proactive approach. Here are key strategies to minimize fraud risks:

- Enhance payment security: Use fraud detection tools with AI and machine learning for real-time transaction monitoring, and enable 3D Secure authentication for added security.

- Implement Multi-Factor Authentication (MFA): Require MFA for account access and high-value transactions to safeguard customer accounts from being compromised.

- Monitor suspicious activities: Track unusual behaviors such as multiple failed logins, high transaction volumes, or discrepancies in billing and shipping addresses.

- Strengthen return policies: Clearly define and limit returns, especially for high-risk items like electronics, to prevent return fraud.

- Invest in address verification: Use Address Verification Service (AVS) to verify billing and shipping address consistency, helping to reduce shipping address fraud.

- Promote secure payment methods: Encourage the use of secure payment options like digital wallets or credit cards with built-in fraud protection to reduce the risk of card fraud.

- Leverage for fraud analysis: eCommerce Fraud Prevention Software for real-time fraud detection and set up alerts for suspicious activity.

- Use secure shipping methods: Implement signature confirmation for high-value shipments and monitor delivery addresses to prevent reshipping fraud.

- Risk scoring for transactions: Assign risk scores to transactions and flag high-risk orders for manual review to avoid fraudulent purchases.

- Implement CAPTCHA and bot protection: Use CAPTCHA to prevent bots from making fraudulent purchases and implement rate-limiting to avoid bot overload.

Mitigating Holiday Fraud with Technology and Trust

A comprehensive approach that combines technology with strategic policies helps e-commerce merchants reduce the financial impact of fraud during peak seasons. Token of Trust’s services. Particularly, our Identity Verification solution, strengthen fraud prevention by preventing Account Takeover (ATO) attacks and reducing chargeback fraud.

Additionally, Token of Trust ensures compliance with data security regulations like GDPR and CCPA, safeguarding customer data and reducing non-compliance risks. By integrating our solutions, businesses build a robust, multi-layered defense against both fraud and regulatory challenges.