Are Non-Nicotine Vaporizers Affected by the PACT Act?

By now, manufacturers, distributors, wholesalers, and retailers of vaporizer products containing nicotine are aware of the PACT Act and its implications on their business. But many companies focusing on non-nicotine vaporizer products have varying awareness and opinions on if and how it applies to them. This article intends to answer the question.

What is the PACT Act?

The PACT Act, first created in 1949 as the Jenkins Act, has expanded several times, with the most important update for vape sales happening in 2020. This change added electronic nicotine delivery systems (ENDS), like e-cigarettes and vape products, under the law through the Preventing Online Sales of E-Cigarettes to Children Act. This update requires online vape retailers to check buyers’ ages, label packages as containing vape products, and follow state and local tax laws. PACT Act sales reports go directly to each state, allowing states to manage their own tobacco tax rules and collect taxes on vape products sold within their borders.

The main goals of these changes were twofold:

- Preventing underage sales: The aim was to make it harder for minors to buy tobacco products, especially online, where age verification is more challenging. Token of Trust provides an Age Verification System to help sellers comply with legal age requirements. Learn more about our Age Verification System here!

- Enhancing regulation: By linking taxes and registration with state authorities, officials could more easily audit companies and monitor consumer age.

How Are Non-Nicotine Vaporizers Affected By The Pact Act?

When the PACT Act was expanded in December 2020 to include ENDs, many believed it applied solely to products containing or intended for use with nicotine. However, the Act defines ENDS broadly, encompassing any electronic device that delivers nicotine, flavor, or any other substance to the user through inhalation.

As a result, various non-nicotine vaping products fall under the PACT Act’s regulations, including:

- CBD vaporizers: Devices intended for vaporizing cannabidiol (CBD) oils or e-liquids.

- THC vaporizers: Devices specifically designed for vaporizing THC concentrates or oils.

- Dry herb vaporizers or flower vapes: Devices for vaporizing dried cannabis flowers rather than oils or e-liquids. These vaporizers are distinct from liquid-based vape pens, yet still fall under the PACT Act due to their inhalation function.

- Flavored e-liquid vaporizers: Devices used to vaporize flavored e-liquids, even if they contain no nicotine.

On March 27, 2021, Congress amended the Preventing All Cigarette Trafficking (PACT Act) to include new regulations regarding the delivery and sales of electronic nicotine delivery systems (ENDS), which include e-cigarettes, “vapes,” flavored, and smokeless tobacco.

Any person or business that sells, transfers, or ships for profit any ENDS in interstate commerce must now register with ATF according to 15 U.S.C. §§ 375 and 376. They must also register with any states that they ship vapes into.

How the PACT Act Impacts Disposable Vape Products

Disposable vape products, particularly those pre-filled with any inhalable liquid, face specific challenges under the PACT Act — even if they do not contain nicotine. This distinction is important: while empty hardware devices, such as batteries or dry herb vaporizers sold without any liquid, are generally not subject to PA-2 reporting, pre-filled devices are. Here’s what businesses need to know:

- PA-2 Reporting Requirements for Pre-Filled Devices

Because disposable vapes come pre-filled with e-liquids—whether nicotine-based, CBD, THC, or flavored varieties—they fall under strict PA-2 reporting requirements. Any business selling or shipping pre-filled disposable vapes must report all shipments to the ATF and state tax authorities. By contrast, empty hardware devices, which don’t contain inhalable substances, typically avoid these reporting requirements. - Shipping Restrictions on Direct-to-Consumer Sales

Disposable vapes are also impacted by direct-to-consumer (DTC) shipping restrictions under the PACT Act. Since they contain inhalable liquids, most carriers, including the USPS, prohibit DTC shipping, requiring businesses to find alternative carriers or limit distribution. Empty hardware devices, which do not include liquids, do not face these same shipping restrictions. - Increased Compliance Costs and Administrative Burden

For businesses selling disposable vapes, PACT Act compliance involves registering with the ATF, the U.S. Attorney General, and state tax authorities, in addition to submitting monthly reports and ensuring compliant labeling and age verification. These steps create an administrative burden and increased costs that can add up quickly. Understanding which products are subject to these regulations—essentially, any device pre-filled with an inhalable liquid—helps businesses streamline compliance efforts, focusing on products that fall under the Act.

When I Sell Non-Nicotine Vaporizer Products, What PACT Act Regulations Apply to Me?

For business owners selling non-nicotine vaporizer products, understanding how the PACT Act applies to various product types is essential for compliance. The following guide clarifies the regulations that impact non-nicotine vaporizers, helping you identify which requirements apply to your business and avoid unnecessary compliance measures.

1. Reporting Requirements (PA-2 Reports) for Disposable and Pre-Filled Products

Any disposable or pre-filled vape device, regardless of nicotine content, is subject to PA-2 reporting under the PACT Act. This includes:

- Disposable vapes and cartridges pre-filled with CBD, THC, or other non-nicotine liquids

- Flavored e-liquid vapes that do not contain nicotine but are intended for inhalation

PA-2 reports must be submitted to both the ATF and applicable state tax authorities for each shipment. By contrast, empty hardware—such as batteries or dry herb vaporizers sold without any liquid—does not typically require this reporting, reducing administrative duties for hardware-only products.

2. Registration and Tax Collection with the ATF and Applicable States

To comply with the PACT Act, businesses selling any form of pre-filled device must:

- Register with the ATF and state tax authorities where products are sold or shipped.

- Submit monthly tax reports to each state to ensure compliance with state-specific excise taxes and regulatory requirements.

Registering helps align your business with both federal and state regulations. For companies selling only empty hardware devices, registration and tax collection requirements are generally less stringent, allowing for a more streamlined process.

3. Shipping Restrictions on Direct-to-Consumer Sales

One of the most impactful regulations under the PACT Act is the restriction on direct-to-consumer (DTC) shipping for devices containing any inhalable liquid. Pre-filled products must comply with the following shipping restrictions:

- Prohibited USPS Shipping: USPS does not allow DTC shipping for these products, meaning businesses must use private carriers who support age verification.

- Adult Signature Requirement: An adult signature upon delivery is mandatory, ensuring compliance with age restrictions.

These shipping restrictions narrow distribution channels for pre-filled devices and require additional logistics to maintain compliant delivery methods. By contrast, empty hardware products are typically exempt from these DTC shipping restrictions, making them easier to ship to consumers.

What This Means for Sellers

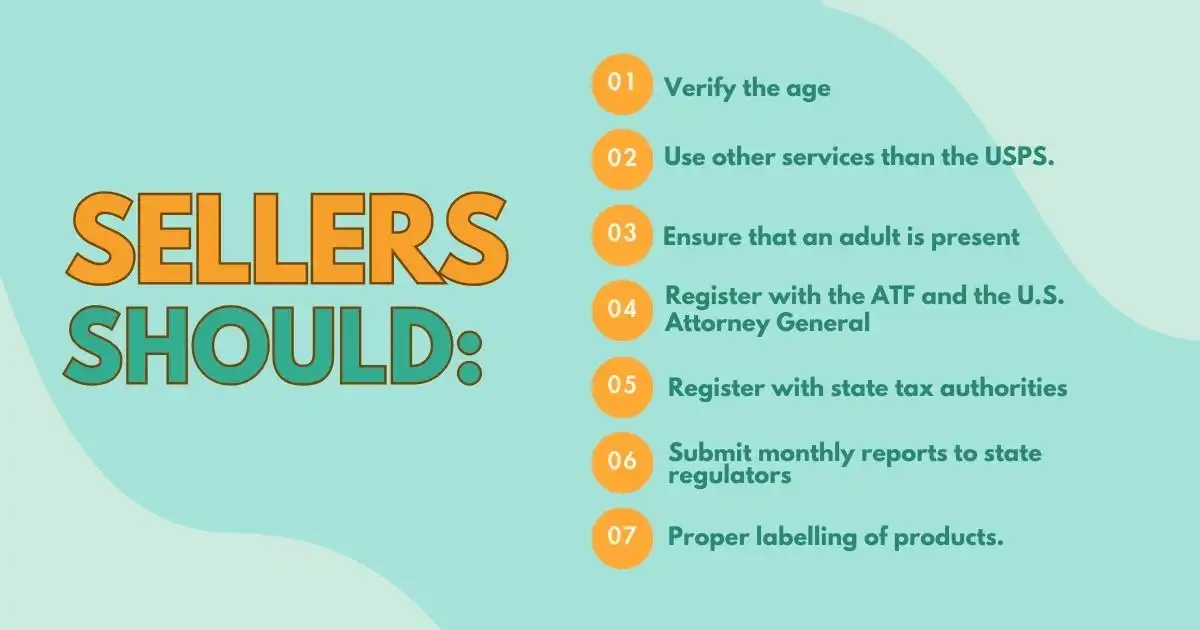

The Attorney General has assigned the ATF to oversee and enforce the PACT Act. Companies that fail to comply with its requirements can face significant fines, civil or criminal charges, and even jail time. Sellers impacted by this legislation must take it seriously.

According to the updated PACT Act, all sellers are required to:

- Verify the age of their customers.

- Use shipping services other than the USPS.

- Ensure that an adult is present to accept each delivery by obtaining a signature.

- Register with the ATF and the U.S. Attorney General.

- Register with state tax authorities where they produce and sell products.

- Submit monthly reports to state regulators detailing all shipments of Electronic Nicotine Delivery Systems (ENDS).

- Label all outside packaging with the statement, “CIGARETTES/NICOTINE: FEDERAL LAW REQUIRES THE PAYMENT OF ALL APPLICABLE EXCISE TAXES AND COMPLIANCE WITH APPLICABLE LICENSING AND TAX-STAMPING OBLIGATIONS.”

PACT Act Still Applies To Non-Nicotine Vaporizer Products

With this in mind, what should you do? Start by researching what the PACT Act requirements are and who can help you “check the boxes” to become compliant. For an effective solution that helps you manage compliance efficiently, consider VapeTaxes.com. We offer comprehensive services, including detailed reporting and e-commerce integration. This is to ensure you stay compliant with the PACT Act and other regulations.

With over a year of the PACT Act expansion being in effect and auditing season upon us, do not delay in becoming compliant. The consequences are severe, but the right partners can help you effectively and efficiently navigate the process sooner rather than later. Contact Token of Trust today to get started.