The Benefits of Using FoxyCart for E-commerce

E-commerce businesses deserve a platform that caters to their unique needs and helps them thrive. FoxyCart empowers you to build and customize your online store exactly as you envision. It seamlessly integrates with your existing tools—whether it’s your content management system, accounting software, or marketing platforms—streamlining the entire process and boosting efficiency.

Because every e-commerce business is different, you need tools that work for you. Let’s dive into how FoxyCart can drive your success!

What is FoxyCart?

FoxyCart is a robust and flexible e-commerce platform designed to help businesses of all sizes sell products online effortlessly. It provides a customizable shopping cart that integrates seamlessly into any website, allowing merchants to manage sales without needing technical expertise. With FoxyCart, you can sell physical products, digital downloads, subscriptions, and even accept donations—all from one platform. This versatility makes it the perfect solution for businesses seeking to enhance their websites with powerful e-commerce features.

Key Benefits of Using FoxyCart

- Quick and Easy Setup

- FoxyCart shines with its simple setup process. You can get started by creating an account and embedding a shopping cart on your existing site with just a few code snippets. This quick integration means you can start selling almost immediately, without the need for extensive configurations.

- User-Friendly Experience

- FoxyCart focuses on providing a smooth and secure checkout experience. This user-friendly design minimizes friction during the purchase process, potentially boosting conversion rates and customer satisfaction.

- Predictable Pricing

- With a straightforward subscription model, FoxyCart eliminates the risk of hidden fees. This predictability makes it easier for small businesses to budget and plan their expenses without unexpected costs associated with plugins or premium features.

- Efficient for Small Businesses

- FoxyCart is tailored for small to medium-sized businesses that need essential e-commerce functions without the extra complexity. If your needs are straightforward, FoxyCart provides a clean and effective solution, allowing you to focus on growing your business rather than managing a complex platform.

- Responsive Support

- As a niche platform, FoxyCart offers dedicated customer support that is known for its responsiveness. You’ll receive personalized assistance, ensuring that any issues are resolved quickly, which can be invaluable for small business owners who may not have technical resources on hand.

How Excise Tax Works in FoxyCart!

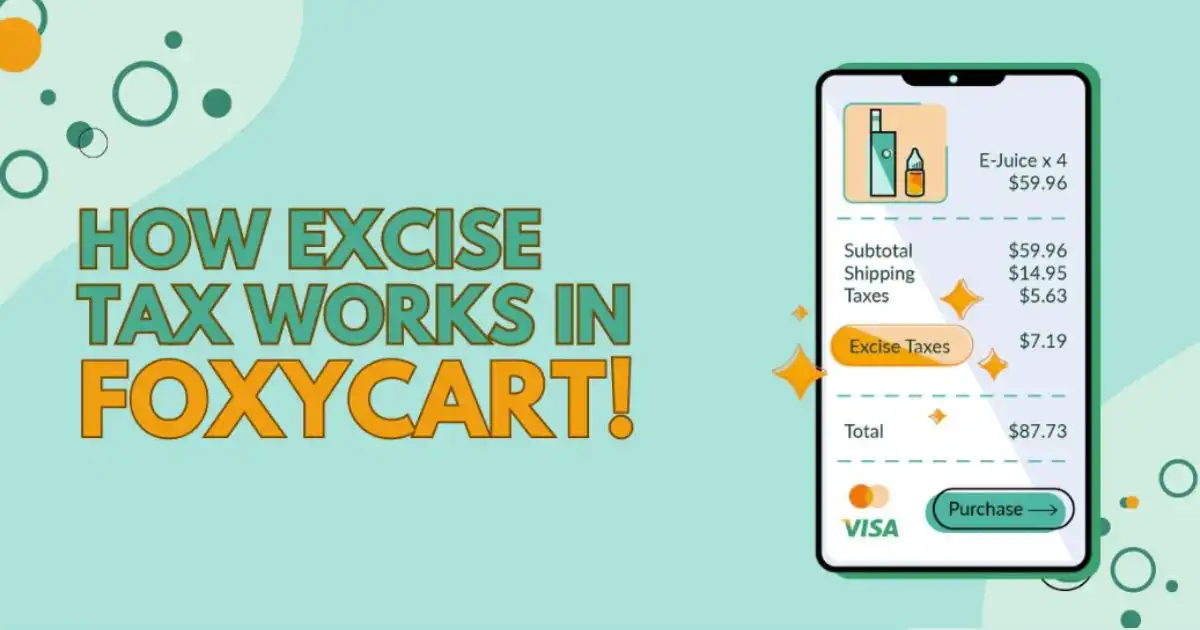

When managing taxes in your eCommerce store, including excise tax. FoxyCart provides the tools you need to efficiently collect and remit the correct amounts.

FoxyCart helps you determine the appropriate sales tax, including excise tax, based on the customer’s shipping address. This is crucial since tax rates can vary significantly by location. For instance, if you sell products that fall under excise tax categories—like alcohol or tobacco—you must apply the correct tax rates for those products in the customer’s state.

Furthermore, you can set up your store to automatically calculate taxes using static rates for simpler tax environments or more complex configurations for states with varying rates. FoxyCart offers built-in and third-party integrations, assisting merchants with complex tax requirements. This enables you to streamline your tax processes without needing extensive tax knowledge. Additionally, you can manage tax rounding at different points. Whether at the individual product price or the cart subtotal, ensuring accuracy.

FoxyCart also considers factors like whether to tax shipping and handling. If you present a combined cost for shipping and handling, you can decide how to approach tax collection in these scenarios. For merchants dealing with tax exemptions or different rates—such as specific rules for software in certain states. FoxyCart’s flexible system allows you to tailor your approach accordingly.

Calculate Your Excise Tax Seamlessly!

Token of Trust offers comprehensive solutions that help e-commerce businesses selling vape and e-cigarette products manage excise tax compliance and age verification requirements. Our VapeTaxes.com platform simplifies the process by automatically calculating the correct vape excise tax rates based on current rules and exemptions. This enables businesses to collect excise taxes directly from customers at checkout, preserving profit margins while ensuring a smooth shopping experience. Furthermore, our software automatically prepares and submits both state excise taxes and PACT Act reports, ensuring full compliance with local regulations.

Additionally, Token of Trust helps you expand your market reach by identifying states that require excise taxes on vape products. Our free excise tax calculator makes calculating tax rates easy, with no complex integrations necessary. On top of that, our age verification tools ensure compliance with legal age restrictions for vape product sales, providing peace of mind.

By leveraging our solutions, e-commerce businesses save time and money while navigating the complexities of tax and age verification compliance. This allows you to focus on growth and customer satisfaction.