Simplify Exemption Certificate Management Today

Selling vape, hemp, and alternative products comes with strict compliance demands, and staying ahead isn’t optional. Yet, many wholesalers still manage exemption certificates manually, relying on spreadsheets, scattered emails, and outdated methods.

This manual approach doesn’t just slow you down. It creates real compliance risks that can cost time, money, and trust.

Additionally, automating exemption certificate management is no longer a future upgrade. So, we’ll show you how this can protect your business, simplify compliance, and fuel growth in 2025 and beyond.

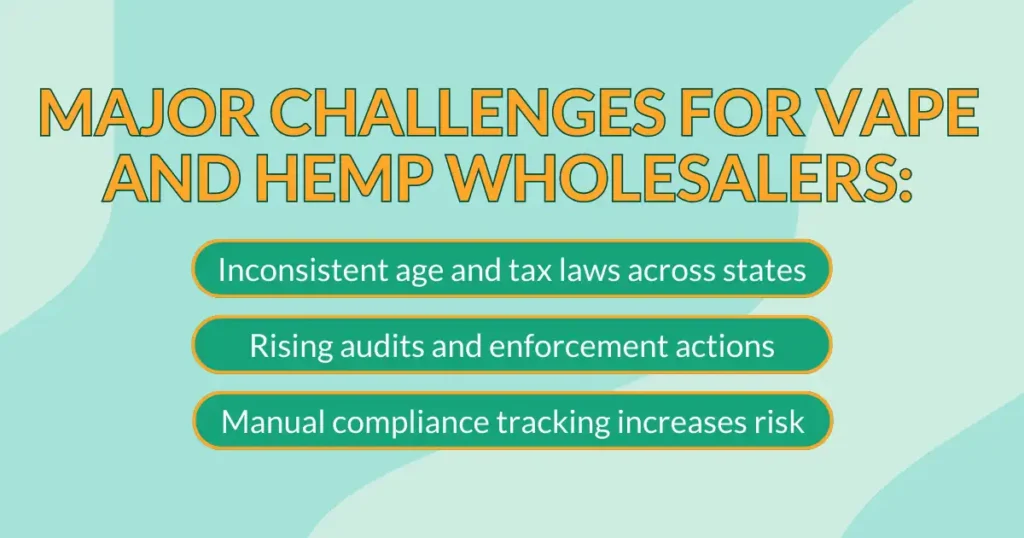

The Compliance Pressure Facing Vape & Alt Product Wholesalers

Managing tax-exempt customers gets harder when you sell tightly regulated products like vape and hemp.

Today’s wholesalers face several challenges:

- Inconsistent age and tax laws accross states.

- Rising audits and enforcement actions.

- Manual compliance tracking increases risk.

Additionally, without a strong exemption process, wholesalers face fines, shipping delays, lost licenses and broken relationships with trusted buyers.

Tax compliance in the vape industry is getting tougher. So, staying ahead now demands proactive strategies and reliable systems.

The Cost of Manual Exemption Certificate Management

Spreadsheets and email chains aren’t enough to manage exemption certificates today.

Common points of failure include:

- Missing or expired certificates that go unnoticed

- No expiration alerts, causing late renewals

- Disorganized records that slow down audits

- Heavy admin burdens that waste team resources

Moreover, one missing certificate during an audit can lead to thousands of dollars in fines and back taxes.

As your business grows, these risks grow with you.

So, manual processes aren’t just inefficient, they’re unreliable in today’s compliance environment.

What Automation Looks Like — and Why It Works

You don’t need to start from scratch to fix exemption certificate management.

TaxCSA offers a specialized platform built to automate exemption certificate management for regulated wholesalers.

In addition, here are the tasks that you can do with TaxCS:

- Collect certificates easily at the point of onboarding or sale

- Validate buyer documents quickly

- Store everything securely in a centralized, searchable portal

- Track expirations automatically with proactive reminders

- Prove compliance during audits with easy exportable records

Howver, document management is only half the solution.

TaxCSA and Token of Trust work together to protect every sale. On the other hand, TaxCSA manages certificates, Token of Trust verifies buyer identities, ensuring you sell only to qualified businesses and individuals.

Together, they offer a seamless system for both verifying who you sell to and documenting every exemption properly.

✅ Automation + Identity Assurance = Full Compliance Confidence

Ready to simplify exemption certificate and buyer verification? Explore how TaxCSA and Token of Trust work together.

The Market Shift — Why Now Is the Time

States are tightening tax enforcement, and wholesalers who delay automation are already feeling the impact. Regulators now expect businesses to maintain complete, accurate records, without exceptions. Yet, even small compliance gaps can trigger major fines, delays, and lost trust.

Tracking systems manually leave too much room for error. As tax rules grow more complex each year, outdated processes create bigger risks for wholesalers. At the same time, modern B2B buyers expect fast, simple onboarding. Moreover, they won’t wait for manual paperwork or wonder whether their exemption documents have been processed.

Digital compliance is no longer optional, it’s the new standard for regulated industries.

Automating your process today delivers:

- Fewer last-minute fire drills

- Faster, smoother sales cycles

- Stronger audit defense

- Less manual burden on your team

“You don’t want to be the last one automating when the next audit rolls around.”

Your 5-Point Checklist for Exemption Certificate Automation

Building a scalable system today prepares your business for tomorrow’s compliance demands. If you’re upgrading your compliance process, make sure it delivers:

✅ Collect certificates during onboarding or checkout.

✅ Auto-track expirations with renewal alerts.

✅ Export audit-ready records instantly.

✅ Store documents securely in a searchable portal

✅ Combine certificate management with identity verification to prevent fraud

Meeting these five criteria doesn’t just protect you from fines. Moreover, it also speeds up sales, builds buyer trust,and keeps your business ready for audits at any time.

TL;DR

Manual exemption certificate management no longer fits today’s compliance demands.

In addition, when you automate exemption tracking and verify buyer identity, you don’t just meet the bare minimum requirements. So, you protect your business, speed up sales, and scale with confidence.

👉 See how Token of Trust can verify your buyers seamlessly.

👉 Explore TaxCSA’s exemption certificate management tools today.

Together, we help regulated wholesalers simplify compliance — and grow without fear.