Vape Compliance 2026: State Directory Updates

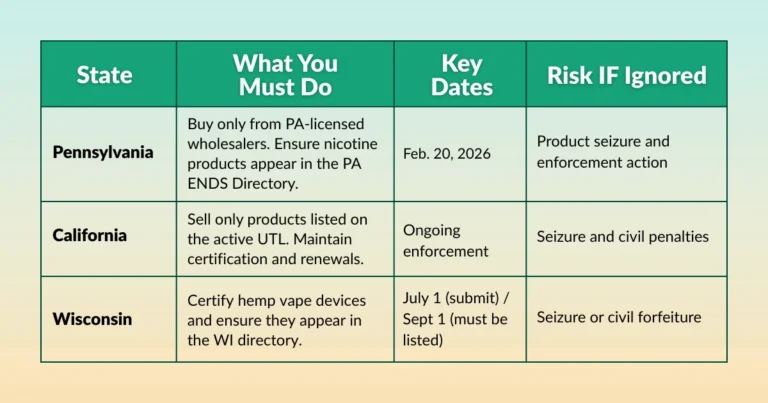

Vape compliance 2026 is becoming more complex as multiple states expand requirements affecting the manufacture, distribution, and sale of electronic nicotine delivery systems (ENDS) and related vaping products. Recent changes include updates to product directory programs, licensing structures, sourcing restrictions, and marketing controls. For businesses operating in the vape sector, compliance now requires closer coordination…